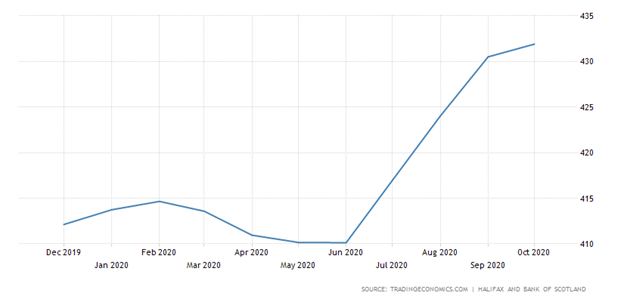

House prices have been rising in recent months, but is this likely to continue and is it sustainable?

According to the UK House Price Index (HPI), house prices have risen by an average of 1.7% since August 2020.

There has been an annual price rise of 4.7% (up from 3.0% in the August data) which is almost a three year high.

To compare, during the same period a year earlier (August 2019 and September 2019) there was only a rise of 0.1%.

Early indications suggest that property prices are 6.3% higher over the year than in November 2019.

So will this trend continue going into 2021?

Read on to find out more or click a jump link below to skip to a chapter that interests you.

Chapters

Current Trends

The average UK property is now valued at £244,513 with property values in England averaging at £261,795, an annual price rise of 4.9%. Unsurprisingly, the South West had the greatest monthly price rise, up by 3.3% and the greatest annual price rise, up by 6.4%, adding weight to the theory that people are looking for a better work/life balance in response to the Covid crisis that’s changed working patterns for many. Property site, Zoopla’s statistics support this showing more sales in wealthier areas, with the South East seeing completions rise by 7% year-on-year. However, the North East saw the lowest annual price growth, with a rise of 3.3%.

Interestingly, house prices in London have only risen by 0.8% since August 2020 with an annual price rise of 4.1% to take the average property value to £496,485. Conversely, house prices in Wales have fallen 1.9% since August 2020 taking the average property value to £170,604.

Current Transactions

The UK Property Transactions Statistics showed that in September 2020, on a seasonally adjusted basis, the estimated number of transactions of residential properties with a value of £40,000 or greater was 98,010. This is 0.7% lower than a year ago, but likely reflects the two month closure of the property market when the UK’s first lockdown hit. Between August 2020 and September 2020, UK transactions increased by 21.3% on a seasonally adjusted basis. [The UK HPI is based on completed housing transactions which are highly seasonal, with more taking place in the summer months than the winter.] In fact, agreed sales in October 2020 are up by 50% compared to October 2019 and sales going through the buying and selling process are up by 67% and over the year, it has taken 23 days less time to secure a buyer within the £400,000-£500,000 property band.

Future Outlook

As the Stamp Duty holiday deadline at the end of March approaches, Zoopla predicts that the housing market is going to see its busiest period in the run up to Christmas in more than ten years. It estimates that an additional 100,000 sales will complete before the 31 March deadline, adding extra pressure to an already busy housing market.

The knock-on effect of the rise in demand is being reflected by pushing house prices up – perhaps artificially, which could be detrimental to the long-term health of the housing market. Affordability has suffered greatly in the pandemic, as potential buyers have had to pull out of their purchases due to being furloughed and the job uncertainty that it brings.

House Prices

Average prices are now starting to drop according to property website Rightmove, with a fall of 0.5% between October and November. This may be an effort by vendors to encourage a sale in time to benefit from the stamp duty holiday as the closing date looms closer. Any delays at this point could mean missing the 31 March deadline even if agreements are finalised in the next few weeks.

Evidence is also showing that if the initial asking price is too high then buyers are less likely to put in an offer even if the price is later reduced to a more reasonable level. On the other hand, while the news is filled with stories of soon to be available vaccines, and house viewings have increased in response, vendors may not be willing to accept unrealistic offers.

What's In Store For 2021?

Meanwhile, Zoopla is warning of a massive dip in property transactions in the second quarter of 2021 once the stamp duty holiday ends, potentially as low as 20-30% below normal levels with an overall slow in growth to 1% over the year. Will house prices respond accordingly or is the temptation of a house in the country enough to buoy up those values for a while longer?

Disclaimer: Cormorant Mortgages does not provide advice in relation to savings and investments. This article is intended for discussion only and does not propose financial advice in any way, and therefore should not be construed as such. Your property may be repossessed if you do not keep up with mortgage repayments. You may be able to obtain cheaper deals by going direct to a lender.